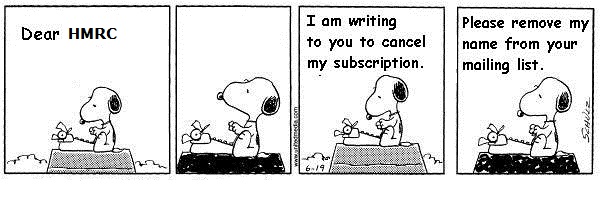

Yes … its a viral list issued by HMRC as a polite prompt to the public to remind them of the looming deadline … ah but its a bit of fun as well, so here you go, here is the top 10 excuses that people really did present …

- My pet goldfish died (self-employed builder)

- I had a run-in with a cow (Midlands farmer)

- After seeing a volcanic eruption on the news, I couldn’t concentrate on anything else (London woman)

- My wife won’t give me my mail (self-employed trader)

- My husband told me the deadline was 31 March, and I believed him (Leicester hairdresser)

- I’ve been far too busy touring the country with my one-man play (Coventry writer)

- My bad back means I can’t go upstairs. That’s where my tax return is (a working taxi driver)

- I’ve been cruising round the world in my yacht, and only picking up post when I’m on dry land (South East man)

- Our business doesn’t really do anything (Kent financial services firm)

- I’ve been too busy submitting my clients’ tax returns (London accountant)

So what happened? Well apparently all of these people and businesses received a £100 penalty from HM Revenue and Customs (HMRC) for filing late. When they appealed against the decision, they used the above excuses as part of their formal appeal, and were (gasp) unsuccessful.

HMRC’s Director General of Personal Tax, Ruth Owen, is also quoted as saying:

There will always be unforeseen events that mean a taxpayer could not file their tax return on time. However, your pet goldfish passing away isn’t one of them.

Oh and least you wonder, I’ve already filed mine, so no last minute panic … but my goldfish was looking a tad nervous there for a bit.

The problem is that regular taxpayers, like you, are missing out on legal and safe deductions, to the tune of hundreds of millions of dollars in unclaimed refunds every year! As a tax professional, it truly breaks my heart, knowing that just a few thousand, or even a few hundred bucks for us “regular guys” out of that vast pool of overcharging could make a world of difference–and they are just sitting there, unclaimed! And with the economy we’re facing now…it’s essential that the “right” professional handles your taxes, books, or other financial matters.